Employment costs to soar in beleaguered hospitality sector

Hospitality firms in Yorkshire could be facing the most arduous financial challenges since the pandemic.

The sector, including food and beverage, accommodation, travel and tourism and entertainment and recreation, is particularly vulnerable to a range of Autumn Budget measures because of a younger workforce, recruitment problems and reliance on discretionary spending by consumers.

Employer National Insurance Contributions (NICs) increase this April by 1.2% to 15%.

Also going up is the National Living Wage for people aged 21 and over and the National Minimum Wage for people of at least school leaving age.

Richard Whitelock – Employment Tax Advisory Partner at Azets Yorkshire

“It is difficult to convey just how difficult these mandatory rises will be for many firms in the regional hospitality sector,” said Yorkshire-based Richard Whitelock, Employment Tax Advisory Partner for Azets, the UK top 10 accountancy and advisory firm.

“There are a lot of cold-sweat calculations going on behind the scenes as businesses here in Yorkshire work out what their new higher breakevens will be – and what needs to be done to recoup the higher outlays from April without hiking prices for weary customers who already tightened belts when inflation hit a 41-year high just two years ago.

“There is no doubt that the sector is set to face the most arduous financial challenges since the pandemic and the subsequent cost-of-living crisis, with the Autumn Budget reportedly adding an additional £3.4 billon in employment costs and workers are likely to bear the brunt.

“What everyone has to bear in mind is there is no longer the business life support measures in place as there were during the national health emergency, such as the bounceback loans and furlough scheme.”

According to industry figures, hospitality is the third largest employer in the UK, with 3.5 million people working in the sector.

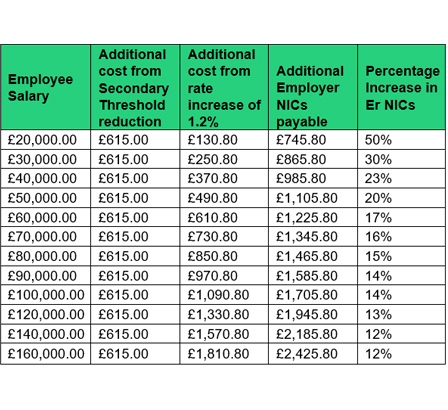

In the Autumn Budget the Chancellor announced an increase in employer NICs; the rate of employer (secondary) contributions will increase from the current rate of 13.8% by 1.2% to 15% this April.

The increase was accompanied by a reduction in the secondary threshold at which employer NICs become payable from £9,100 to £5,000 per year – this reduction in the secondary threshold alone will cost employers an additional £615 per employee.

The Employment Allowance has also been increased from £5,000 to £10,500 and the restriction which prevented employers who incurred a secondary Class 1 NICs liability of more than £100,000 will be removed, thus enabling more employers to claim the allowance and will help shield some of the smallest employers from the increases.

The National Living Wage goes up on 1 April from £11.44 to £12.21, an increase of 77p which will also increase both employer and employee pension contributions for affected workers.

With the National Minimum Wage, it will be £10 instead of £8.60 for those aged 18 to 20, a rise of £1.40, and, for under 18s, £7.55 from £6.40, up £1.15. Apprentices will receive £7.55 instead of £6.40, up £1.15.

“These increases, at the same time as the rise in employer NICs, and higher corporation tax on profits, will quickly erode already-squeezed profit margins and could break the camel’s back for some employers,” said Richard

Negative mitigations by businesses to reduce employment costs could include:

Reduced hiring of new roles: For companies with significant wage bills the additional cost may lead them to reconsider creating new roles. For example, an employer with 50 employees, receiving an average salary of £50,000, will incur additional NICs costs of over £55,000.

Recruitment freezes: Instead of filling vacant roles, businesses may require existing employees to take on additional responsibilities, increasing workloads.

Paused or reduced benefits enhancements: Plans to improve employee benefits, such as healthcare, pension contributions or moves to a living wage, could be deferred to accommodate the rising costs.

Restrained salary increases: Employers who had budgeted for a 4% rise in labour costs may feel compelled to reduce planned salary increases, affecting employees’ earnings potential.

The hospitality sector was already under pressure, with 3,712 insolvencies relating to accommodation and food service activities alone in England and Wales in the 12 months up to August.

Richard added: ”Thankfully, there are proactive measures employers can take to reduce the cost impacts. We estimate that companies which utilise salary sacrifice, sometimes referred to as Pension Salary Exchange (PSE), can reduce the NIC impact costs by between 20% and just over 40%, depending on salary level.

“The sooner PSE can be introduced, the sooner the savings can begin to mitigate the impact of the NIC increase.”

With PSE, the employee stops making personal pension contributions and reduces their salary to match that contribution whilst the employer increases its contributions to ensure the total amount added to the employee’s pension fund remains the same as before.

This produces NIC savings for both employer and employee, creating a rare ‘win-win’ situation of increased net pay or increased employees’ pensions alongside savings for the business which can be retained and/or reinvested in staff, or now used to mitigate the NIC increase costs.

Azets’ Employer Solutions Team are getting calls from clients requesting cost impact analysis of the NIC changes and support with savings data and PSE, along with reviews of existing records to ensure compliance and helping register employers for voluntary payrolling of benefits, said Richard.

Azets has regional offices in Leeds, Bradford and York where it employs 335 people.