Bradford Buy-to-Let 2025: Performance, Forecasts and Why Investors Are Paying Attention

Yorkshire continues to establish itself as one of the strongest-performing property regions in the UK. The latest analysis from our regional insights report shows that several Yorkshire districts have significantly outperformed national averages, and the most recent Savills Residential Forecast places Yorkshire and the Humber as the number one region in the UK for projected capital growth over the next five years. This wider regional trend provides an essential backdrop when evaluating buy-to-let investments in Bradford, particularly for landlords comparing opportunities across West Yorkshire.

Yorkshire and Humber Market Snapshot

Yorkshire and the Humber has delivered 28.8 per cent growth over the past five years, with West Yorkshire performing even more strongly at 30.7 per cent. Bradford’s 32.9 per cent growth places it ahead of Leeds, York and Sheffield, reinforcing its position as one of the region’s highest-performing value markets. Wakefield, Doncaster and Rotherham have also shown impressive movement, helping to cement West Yorkshire as one of the most consistent growth areas in the UK.

This table highlights the gap emerging between Yorkshire and the wider national picture, and it sets the stage for why investors are increasingly reviewing the opportunities outlined in our Yorkshire property market insights report.

Why Bradford Stands Out for Buy-to-Let Investors

Bradford’s strength lies in the combination of affordability, strong rental demand and above-average capital growth. Entry prices for two and three-bedroom homes typically range between £80,000 and £150,000, giving landlords a far more accessible starting point than neighbouring Leeds or York. With a tenant base made up of students, professionals, commuters and families, demand remains consistent throughout the year.

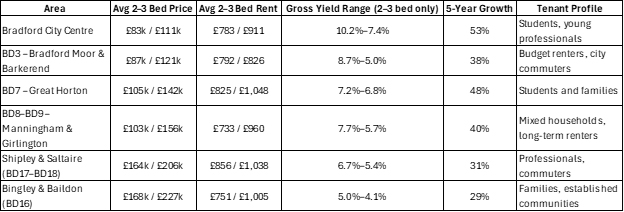

Where Bradford becomes even more interesting is in the way performance differs across individual postcode areas. The table below, taken from our buy-to-let analysis, gives a high-level comparison of pricing, yields and growth across the city.

Bradford District Snapshot: Pricing, Yields and Growth

This table illustrates how varied the market is across Bradford. City-centre homes deliver the strongest yields, reaching 10.2 per cent, while still achieving exceptional five-year growth of 53 per cent. Districts such as BD7 and BD8–BD9 strike a balance between affordability and demand, appealing to students, mixed households and long-term renters. Meanwhile, suburban areas like Shipley, Saltaire, Bingley and Baildon attract families and commuters, offering stability-led performance with steady capital appreciation of 29 to 31 per cent.

For investors reviewing where to focus their search, the full district-by-district breakdown, including yield variations, demand patterns and five-year growth trends, is explored in our Bradford buy-to-let market analysis.

Supporting Investors Across Yorkshire

Roberts Renovations works with landlords who want a data-led foundation for decision-making. Their regional and Bradford-specific reports help investors interpret pricing trends, compare rental fundamentals and identify areas where renovation can create additional value.

For investors exploring opportunities across the region, Roberts Renovations provides property sourcing services across Yorkshire, offering transparent assessments of demand, pricing and the long-term viability of each opportunity.

As Yorkshire moves into a period forecast for the strongest capital appreciation in the UK, Bradford’s combination of affordability, performance and regeneration activity positions it as one of the most interesting buy-to-let markets for 2025 and beyond.