New Yorkshire Building Society mortgage helps first-time buyers get on the housing ladder earlier, for just £5k

Yorkshire Building Society is today launching its new and innovative £5k Deposit Mortgage to help tackle one of the biggest issues preventing people from achieving their homeownership dreams.

The new mortgage is available directly to customers and via brokers through Accord Mortgages – the lender’s intermediary-only arm.

This new and innovative product, believed to be the first of its kind in the UK, does exactly what the name suggests, enabling first-time buyers with a £5,000 deposit to purchase a property valued up to £500,000.

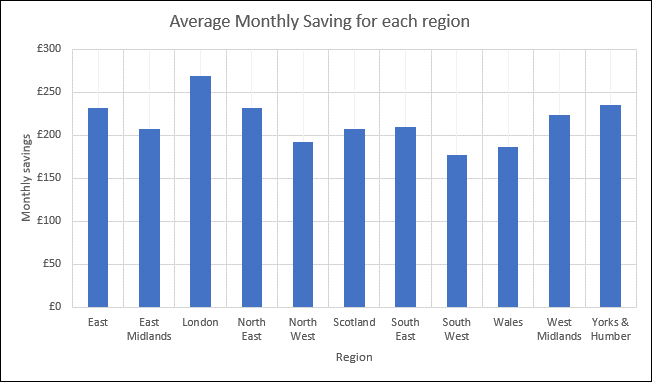

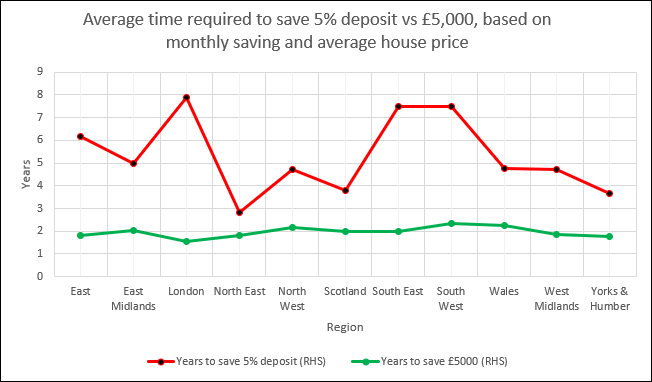

Director of Mortgages Ben Merritt said painstaking research the Society has conducted showed that £5,000 was the magic amount which would shorten the time needed for first-time buyers to get mortgage-ready, and make it fairer no matter where they live in the country.

For someone taking out the typical* £200,000 first-time buyer mortgage, this would mean a loan-to-value of 97.5% .

£5k Deposit Mortgage product details at a glance

• Five-year fixed rate at 5.99%

• Available to first-time buyers only

• Minimum deposit requirement £5,000

• Maximum property value £500,000

• Available on a capital and interest basis only

• Maximum age at end of mortgage term 70

• Available on residential house purchases only

“Our analysis showed a deposit of £5,000 – compared to a typical 5% – would make a huge difference to first-time buyers across the country by reducing the time it takes them to save up and achieve homeownership, from a maximum of 7.5 years (in London), to around 2.5 years (see chart below),” explained Ben.

Data sources**

At the same time, lending responsibly is very important , added Ben: “While £5,000 represents a 1% deposit for those who need to borrow the maximum amount available, the key is that customers are still putting money into a deposit, they still have to demonstrate strong creditworthiness and pass an affordability assessment to be eligible for a £5k Deposit Mortgage. We have a duty to encourage financial responsibility in anyone taking out a mortgage,” added Ben.

“It creates a level playing field for those who don’t have financial support from their families to fall back on, after research for our recently-published Home Truths report showed that 38% of first-time buyers now receive financial help from friends and family to have the chance of stepping onto the housing ladder.

“The Society’s research among 500 first-time buyers for its Home Truths report, published in September 2023, showed that 78% of people in this category feel homeownership is becoming an elite privilege, while 63% believe the UK is in danger of becoming a nation of renters.

“This is a situation we believe can’t be allowed to continue,” added Ben.

“In our report, we’ve recommended that the Government re-introduce some form of state support for first-time buyers, and an industry-wide review involving lenders, trade bodies and the Government, is needed to start to fix what’s broken in the UK housing market.

“However, for now, we hope this £5k Deposit Mortgage will help first-time buyers overcome the deposit barrier as we believe this group deserve a chance of homeownership, because they are a vital part of a vibrant housing market.”

Iona Bain, Broadcaster, Financial journalist and author of ‘Own It!’, said: “Despite the many myths out there which suggest first-time buyers could afford to own their own homes if they just stopped indulging in expensive coffees and avocado on toast, the reality is that things are tough for them thanks to house prices equating to many times their earnings and high costs which make it difficult to save up a deposit. For some, saving the traditional deposit of 5% or more of the value of their own home is simply not doable, particularly if they live in a more expensive part of the UK and/or don’t have family help to fall back on.

“All of this means fresh solutions are needed to avoid first-time buyers giving up on the idea altogether, and it’s great to see a lender like Yorkshire Building Society playing its part and helping with innovative products like the £5k Deposit Mortgage. Raising £5k will be achievable for many more people and hopefully encourage them to save and make the other sound financial choices which are so important to getting and managing their own home, knowing that their goal is within realistic reach.”

Customers interested in finding out more about this product will find further information on our website, in our branches, over the telephone or by speaking to their mortgage broker. Customers ready to apply can arrange a mortgage appointment over the phone by calling Yorkshire Building Society on 0345 127 2728, or by contacting their mortgage broker.