Yorkshire team advises Mainprize Offshore on partial sale and multi-million pound development investment

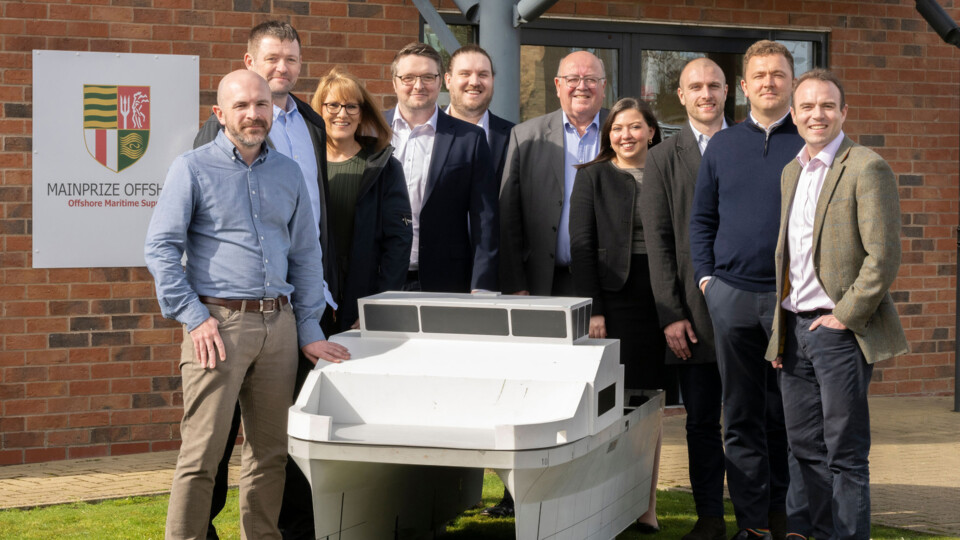

A team of Yorkshire advisers has assisted the shareholders of Mainprize Offshore, a designer and operator of bespoke crew transfer vessels to the offshore wind industry, on its partial sale to private equity fund, Alcuin Capital Partners (“Alcuin”), together with the re-financing of its fleet with Siemens Financial Services.

Under the terms of the deal, Alcuin has partnered with Scarborough-based Mainprize Offshore, to help drive its ambitious growth plans, expand its fleet and take full advantage of the market opportunity.

The current directors and founders of the business, Bob and Sharon Mainprize, will continue to operate and grow the business alongside Alcuin and the senior management team.

The shareholders of Mainprize Offshore were advised by a team from Andrew Jackson Solicitors LLP comprising Philip Ashworth, Matthew Smith and Nicole Waldron (corporate); Fiona Phillips (tax); Robert Hill (property); Dominic Ward and Rebecca Forder (shipping); and Nick Wilson (employment). Members of the Yorkshire-based corporate finance team from Azets were Stephen Garbett and Martin Miller (corporate finance), Steve Holmes (corporate tax), and Richard Whitelock (employment taxes).

Alcuin were advised by a team from Stephenson Harwood led by Sam Gray and Gerald Seeto.

Bob Mainprize, one of the selling shareholders, said: “We are very grateful to Philip, Stephen and their respective teams at Andrew Jackson and Azets for all the support and hard work they have put in over the last few months and years to facilitate this significant investment in the growth and development of our business.”

Philip Ashworth, corporate partner at Andrew Jackson, said: “We are absolutely delighted to have assisted Bob and Sharon, the shareholders of Mainprize Offshore, having assisted the company through its rapid expansion over the past 10 years.

“It has been a pleasure to act for Bob, Sharon and their team and we are confident that they will go from strength to strength.

“The complexity of a private equity and debt funding deal was added to by the multi-flag vessel fleet operated by Mainprize.”

Stephen Garbett, corporate finance partner at Azets, added: “It has been a pleasure to have negotiated and delivered the Mainprize investment opportunity.

“This transaction not only underscores its leading position in the crew transfer vessel (CTV) market within the burgeoning offshore renewables sector, but also recognises the family’s considerable contributions to date.

“This partnership marks a significant milestone for Mainprize Offshore, setting the stage for accelerated growth and innovation in the renewable energy sector with ambitious plans for new vessel builds.”

Nick Seaman, partner at Alcuin Capital, said: “Mainprize Offshore is a leader in the European CTV market and we are delighted to have partnered with Bob, Sharon and the wider team.

“The business enjoys strong relationships with several of the largest global wind farm developers and operators, and will play a key role in supporting the rollout of European offshore wind and the transition to net zero.

“We are excited to work with the team to help them expand and develop their fleet.”

Azets has offices in Leeds, Bradford and York. Andrew Jackson has offices in York, Hull, Grimsby and Scarborough.

Financial details of the deal were not disclosed.